Did you know that, depending on your income leading up to retirement, you could end up paying higher Medicare premiums than you anticipated?

As you transition into retirement, your income often decreases — but Medicare doesn’t immediately adjust for that. Due to a cost-sharing provision called the Income Related Monthly Adjustment Amount (IRMAA), retirees with higher incomes pay more for Medicare Parts B and D.

Here’s the catch: IRMAA is based on your income from two years prior.

That means if you retire in 2026, your Modified Adjusted Gross Income (MAGI) from 2024 will determine your Medicare premiums. For many, that pre-retirement income can trigger significantly higher costs than expected.

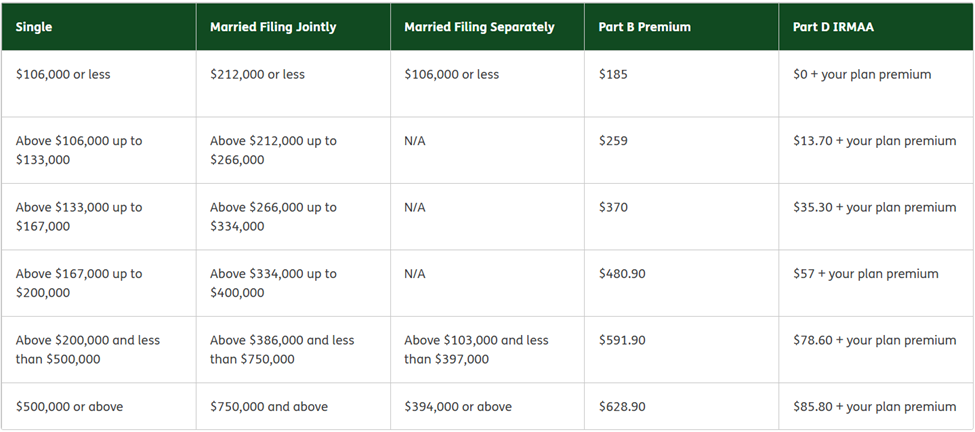

Below is a chart showing the tiered IRMAA brackets for 2025, which illustrate how premiums rise as income increases.

How to Estimate Your Future Medicare Premium

To get a sense of what you might pay if you retire next year:

Grab your 2023 tax return and locate your Adjusted Gross Income (AGI).

Add to this:

Any tax-exempt interest (e.g., municipal bond income)

Any US savings bond interest used to pay for education, and

Any earned income living abroad not already included in your AGI

The total is your Modified Adjusted Gross Income (MAGI) — the number Medicare uses to set your premium level.

What If Your Premium Seems Too High?

If your current income is much lower than it was two years ago, there’s good news — you can appeal your Medicare premium through the Social Security Administration (SSA) due to a life-changing event, such as a work stoppage (retirement).

Planning Ahead

Understanding how IRMAA impacts your Medicare costs is an important part of preparing your retirement income strategy.

Want to explore how to integrate Medicare decisions into your broader financial plan? We’d love to help you prepare with clarity and confidence.

Learn more here 👉 https://www.connected-wealth.com/next-steps.