Did You Know you can Super-Charge your retirement savings in your 60’s?

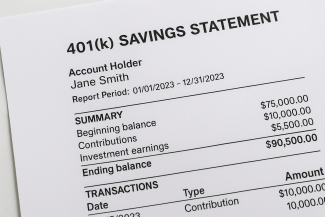

For most people, saving in an employer sponsored retirement plan, like a 401k, is a key component of their savings goals, especially in peak earnings years leading up to retirement.

Thanks to the Secure Act of 2022, starting in 2025:

Individuals between the ages of 60-63 can make an additional “super catch-up” contribution into their 401(k) of $3,750 above the annual IRS maximum of $23,500.

This is in on top of the standard catch-up contribution of $7,500 for those over 50.

This means you could potentially save up to $34,750 per year in your 401(k) during those critical years

However, there is a caveat starting in 2026: Anyone earning over $145,000 in the prior year will be required to make all catch-up contribution, standard or super, as after-tax into a Roth 401(k). As such, your employer will need to offer a Roth 401(k) option to make these catch-up contributions possible.

These enhanced savings options can provide a powerful boost in the years leading into retirement. If you’d like to explore how these strategies fit into your current retirement plan, we’d love to help.

Take your next step here: https://www.connected-wealth.com/next-steps.